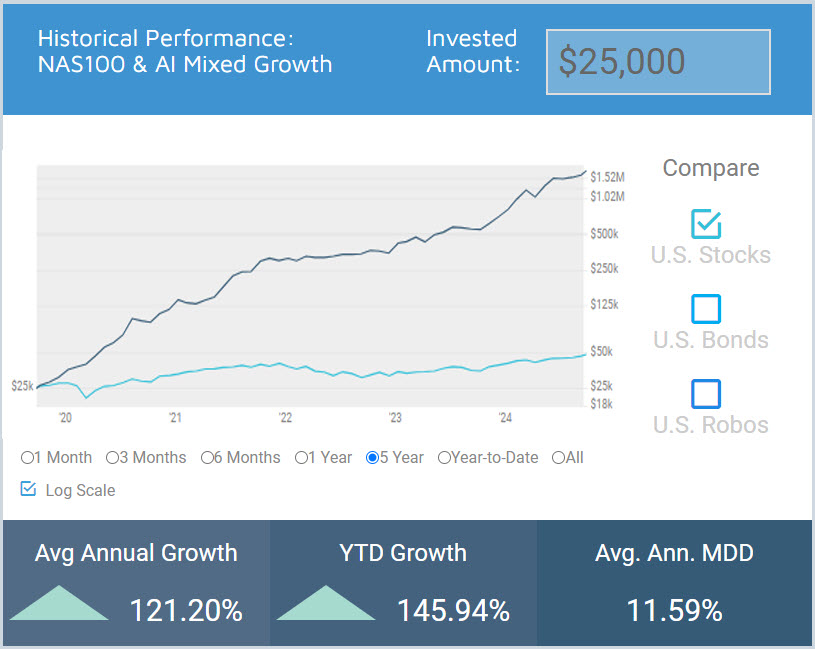

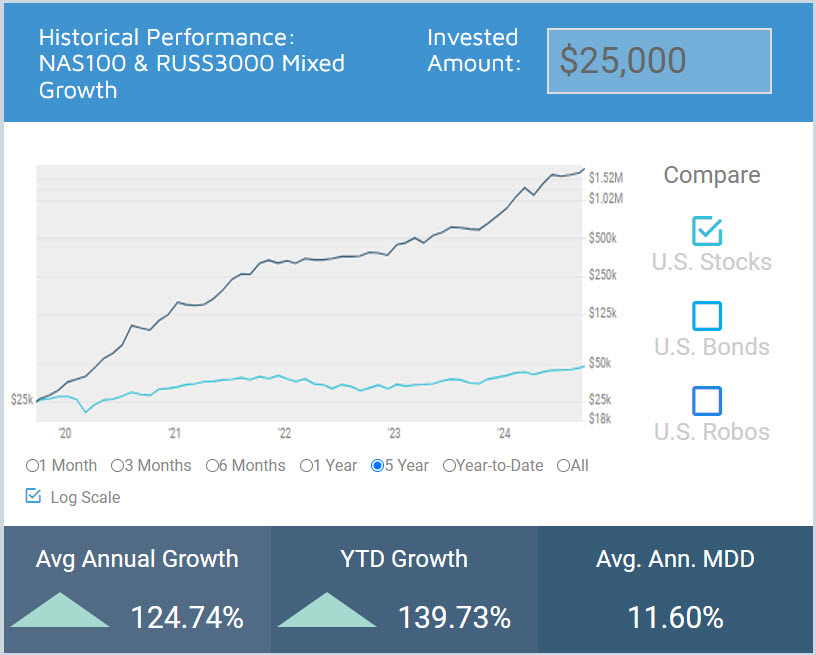

There is no more classic approach to investing than "Buy and Hold". The extensive use of Index Funds attests to its popularity. In bull markets, this approach can certainly yield great returns, especially if the investor selects an Index Fund that is in a strong growth mode, like one based on Artificial Intelligence stocks.

Is there is a way to get much higher returns than this "Buy & Hold" approach? OmniFunds is based on investing in lists of stocks, such as today's "A.I. Stocks" group. The difference is in how it switches between stocks to maximize gains and minimize draw downs. In this article, Steve Byrne shows a recent example that demonstrates a dramatic improvement in returns using the OmniFunds approach.

Click Here for Steve's Full Article, "Comparing Buy & Hold investing to OmniFunds"