Ed demonstrates the enhancement and new V2 OmniFunds in this 9-Minute video.

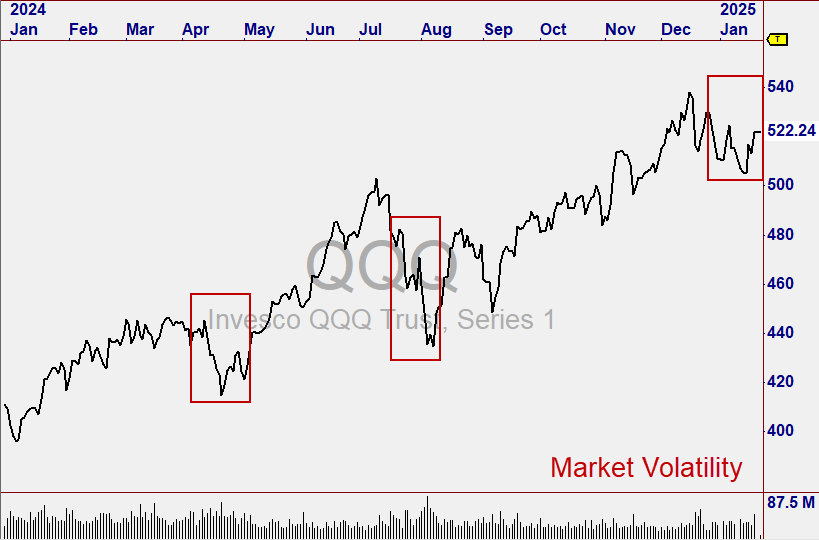

OmniFunds can determine bullish and bearish Market States, which enables them to stop trading in bear markets. But from 12/20/24 to 1/20/25 we saw an unusual market that wasn't really a bear market - it was indecisive, moving strongly up for a day or two, followed by strong downward movement and repeating the pattern - basically "whipsaws" that led to a modest draw down.

We realized this kind of indecisive, volatile market happens from time to time, and agreed it would be really great if our OmniFunds could detect that situation, in order to reduce trading in those cases.

Our esteemed Algo Designer, Stephen G. Byrne took on this challenge and began testing ways to detect such a market. The result of his work is the new "Version 2" OmniFunds, which were just added to the new OmniFunds Beta Page*. They do a great job of avoiding these volatile, "whipsaw" markets. HOWEVER, the additional benefit of this new Risk Control was both surprising and exciting!

In each case, RETURNS improved by a substantial margin, with draw downs maintained within a few points of the originals. These new V2 OmniFunds are showing one-year simulated returns from 200% to 250%, with max draw downs in the 10-13% range. That is simply phenomenal!

While past performance is not a guarantee of future results, we are especially encouraged by the 20-year simulation, showing these new OmniFunds beating their predecessors' performance by as much as 25% per year.

One way to approach a new OmniFund is to reduce allocation as explained in Higher Returns with EVEN LESS Risk. If these stats are replicated in live trading, investing just 25% would mean a 50% annual gain, and draw downs would be around 2-3%. I'm fairly sure that most investors would be quite happy with that. But account allocation is a decision each OmniFunds investor must make on his or her own. It can be changed at any time on the MyOmniFunds dashboard.

Sincerely,

Ed Downs

*About the Beta OmniFunds Page

You can reach the Beta OmniFunds page by scrolling to the bottom of the OmniFund List on the Explore page and clicking the Beta OmniFunds link. Then, select one of the Beta OmniFunds to see its historical equity curves and parameters. We expect to keep these OmniFunds in Beta for 90 days to let the build some trading history, and then move them to the Explore page.