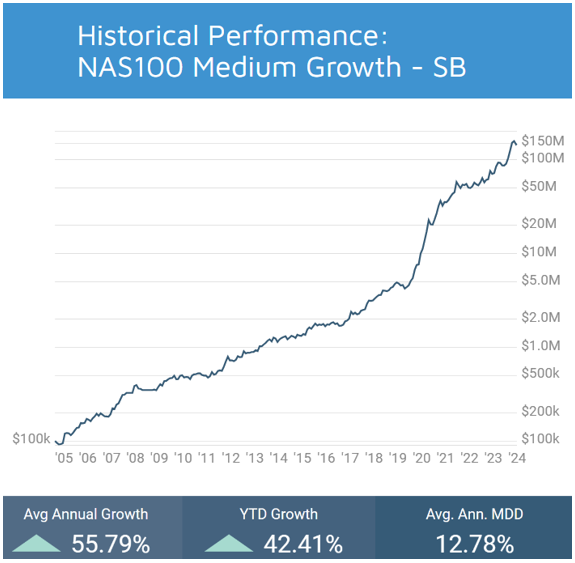

OmniFunds by Stephen G. Byrne. Steve has been an avid user and contributor on OmniFunds since it was first released in 2016, and been highly instrumental in the testing of OmniFunds 2 in 2024. He performed thousands of hours of research to develop the two OmniFunds that have been released in OmniFunds 2, NAS100 Medium Growth and NAS100 Safe Harbor. Below are his descriptions of each. - The OmniFunds 2 Team

Performance as of May 15, 2024.

Click here for recent performance.

About NAS100 Medium Growth

"This OmniFund is designed to capitalize on the explosive growth potential of FANG-like stocks. It is comprised of a selection of High-Cap. stocks from the NAS100 Index List. The average annual growth over the last fifteen years is over 50%.

The selected stocks are stocks with a proven track record. Top-performing stocks showing signs of short-term downtrends are promptly replaced. During market-wide downturns, the Market-State filter ensures that investments remain protected.

The selected stocks are High-Cap. Stocks which are less prone to whipsaws, nevertheless, protection is added to avoid high growth spikes or big sell offs that typically appear at Earnings Dates.

This OmniFund highlights the benefits of compounding; the results since 2019 have been outstanding. The Omnifund blew past the market downturn of 2022."

- Stephen G. Byrne

IFM Disclaimer: Before engaging any OmniFund, potential investors are urged to review the Explore Page to examine the historical trades so they understand the types of symbols and allocations that are used in the OmniFund.

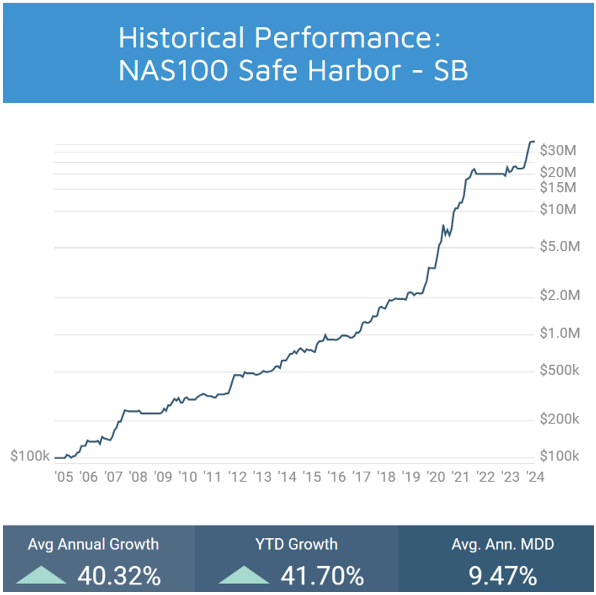

Performance is as of May 15, 2024.

Click Here for recent performance.

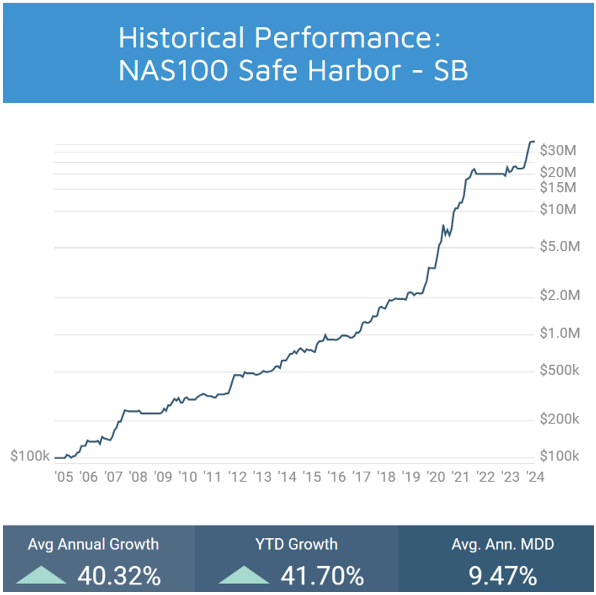

About Safe Harbor

"For those seeking a conservative approach without compromising on potential gains, this Medium Growth Omnifund is the perfect choice. It is designed with a focus on robustness and safety.

The selected stocks are High-Cap. Stocks which are less prone to whipsaws, nevertheless, protection is added to avoid high growth spikes or big sell offs that typically appear at Earnings Dates.

Stability is prioritized in this Omnifund while still offering opportunities for significant short-term gains, especially during market uptrends.

This Omnifund will give you peace of mind, knowing your investments are safe. Drawdowns are limited, as are market downturns."

- Stephen G. Byrne

IFM Disclaimer: Before engaging any OmniFund, potential investors are urged to review the Explore Page to examine the historical trades so they understand the types of symbols and allocations that are used in the OmniFund.