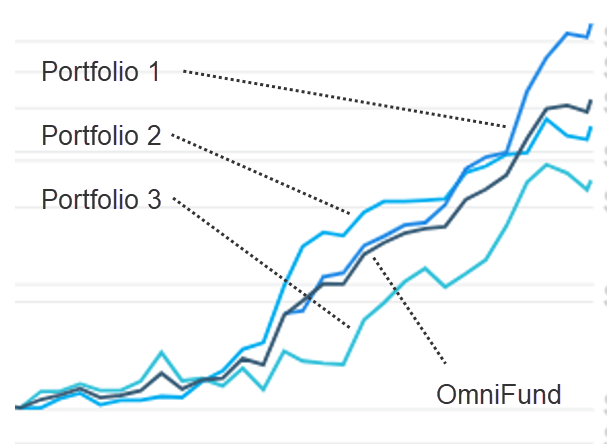

It is with great pleasure that I am announcing the release of OmniFunds 2 - a new platform based on the original OmniFunds, but greatly enhanced based on what we have learned since OmniFunds 1 was released in 2017.

OmniFunds 2 is based on several new concepts:

Trading Multiple Portfolios. The original site only allowed 2 portfolios, and allocation between them was fixed. OmniFunds 2 spreads allocation across as many Portfolios as the OmniFund designer wants to include in the OmniFund

Avoiding Earnings Risk: Every Portfolio can be set to have an Earnings Test, such that any symbol that is within X days of having an Earnings Report published will be avoided by OmniFunds. Likewise, the software can wait for Y days after an Earnings Report to allow the stock to be traded.

Allocation Control: OmniFunds 2 has a setting at the OmniFund Level that allows a maximum percentage per symbol to be specified. This avoids cases where the user does not want to be allocated more than (say) 50% in any single position. There is a counter argument that investing 100% in the best stock in the market is a viable approach, and evidence would suggest this is true. But now, the OmniFunds Pro user can control this aspect of allocation to suite their requirements.