Condor Capital Wealth Management recently released their Robo Report for Q1 of 2024. As with all other years we have investigated, the Robo Advisors continue to perform very poorly, compared to the overall stock market.

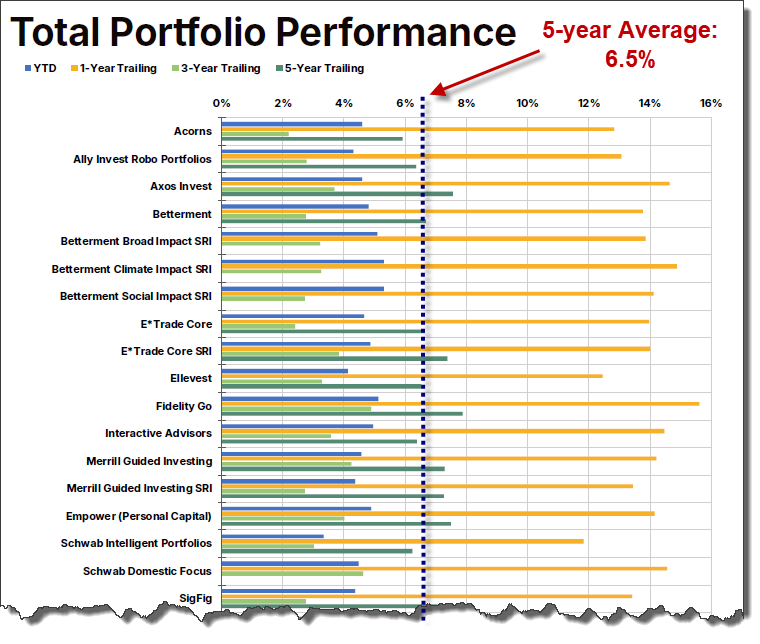

In the middle of the Report is a table showing the main Robo Advisor performance for the past 5 years, 3 years, 1 year and Year to Date (Q1).

Focusing on the SOLID GREEN line, we can see the average annual gain over the past 5 years was only about 6.5%.

By contrast, the market was up an average of about 14% per year over the past 5 years, which is more than DOUBLE the Robo Returns.

Here's an image of the Dow Jones Industrial ETF, DIA.

Year after year, the evidence continues to suggest you would be better off buying ANY market index ETF, such as SPY, QQQ, or DIA compared to investing in pretty much any Robo Advisor.

Once again, we see that Robo Advisors consistently under-perform the major market indices. As we say here at IFM, "Returns Matter." Because they do.

Download The Robo Report:Visit Condor Capital Wealth Management for archived Robo Reports going back to 2017. You can also click the link near the top of the page to download the latest edition.